Proposal overview

V3 Retroactive Funding

Simple Summary

We propose that the Aave DAO retribute a total of $16.28M in retroactive funding to Aave Companies for development of Aave Protocol V3. This total includes $15M for work performed directly by the team over the course of more than one year and $1.28M for costs paid to third-party audit services.

Abstract

Following the successful launch of V3 of the Aave Protocol, this Aave Request for Comment (ARC) seeks community feedback and validation for a governance proposal to the Aave DAO seeking retroactive funding for the development and deployment of V3 by the Aave Companies.

Aave V3 provided enhanced features to the Aave Protocol based on community feedback, solving limitations in V2 while pushing important new features to the forefront of the protocol and contributing to the overall success and strength of the Aave ecosystem.

Some of the important new features include:

- New modes such as the High Efficiency Mode and Isolation Mode which allow for increased capital efficiency whilst limiting risks for the protocol.

- Risk Management Improvements providing additional protection to the protocol through risk caps and other tools.

- L2-Specific features which improve user experience and reliability.

- Portal, which allows assets to seamlessly flow between Aave V3 markets over different networks

We propose that the Aave DAO retribute $15 million (incurred work) and $1.28 million (audit) to the Aave Companies to retroactively fund the development of V3. This funding request covers work done by members of the Aave Companies over the course of more than a year.

The full proposal can be found here: https://governance.aave.com/t/arc-aave-v3-retroactive-funding/9250

Motivation

Introduction

A focus on risk management and capital efficiency and a contemporaneous reinforcement of the flexibility and decentralization of the protocol has been instrumental in the success of Aave V3.

Aligned with Vitalik’s take on retroactive public goods funding —it’s easier to agree on what was useful than what will be useful—the benefit of hindsight allows the community to make an accurate and fair quantification of the work done on V3 against the backdrop of V3’s post-launch success, as well as the potential for V3 moving forward.

This ARC follows this logic, seeking retroactive funding for the work that went into V3, which allows the community to view V3’s success since its launch, as noted in the initial proposal: “The community will also be able to decide whether to provide retroactive funding to those who contributed to the creation of V3, and how much funding to provide.”

Context: Decentralization and Incentivizing Contributors

It is imperative that the Aave protocol ecosystem remains as decentralized as possible. This is why contributors to the Aave protocol such as BGD Labs, Certora, SigmaPrime, Llama and Gauntlet have been able to build sustainable businesses within the Aave ecosystem. By working on the protocol, interacting with governance, and collaborating, all these different contributors add to the decentralized space.

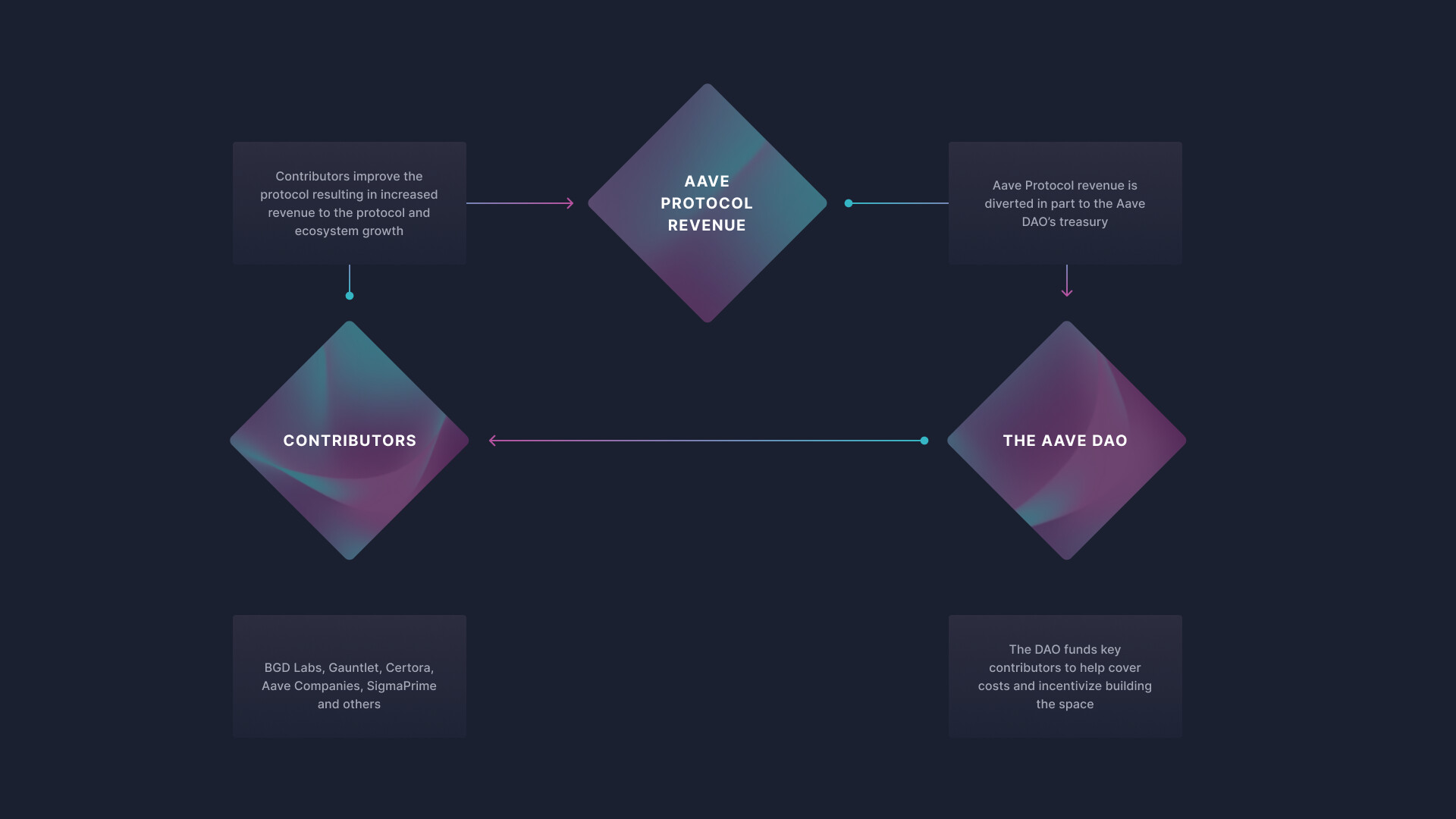

Contributors interact with the protocol and the DAO in a symbiotic circle, as demonstrated in the diagram below:

Each part of this symbiotic circle is integral to the whole. Contributors help to develop the protocol and ensure that protocol revenue continues to grow in a sustainable manner. Innovations and contributions help attract more users by improving user experience and developing new products and services. Protocol revenue, in part, then gets redirected to the DAO; bolstering the DAO treasury to continue fuelling innovations in the Aave ecosystem.

The DAO has the ability to fund contributors within the ecosystem, spurring further innovation and ensuring that contributors can operate successfully in this environment. This incentivizes groups to continue to build, in turn contributing efforts that benefit the Aave community and the cycle continues.

Therefore, for the Aave Protocol to continue to develop, contributors need to be able to build and sustain successful businesses through decentralized funding methods within the ecosystem.

Aave Companies as a Contributor

The revenue created across versions of the Aave Protocol adds to the sustainability of the DAO, facilitating the funding of a variety of contributors within the ecosystem through various types of cryptoassets.

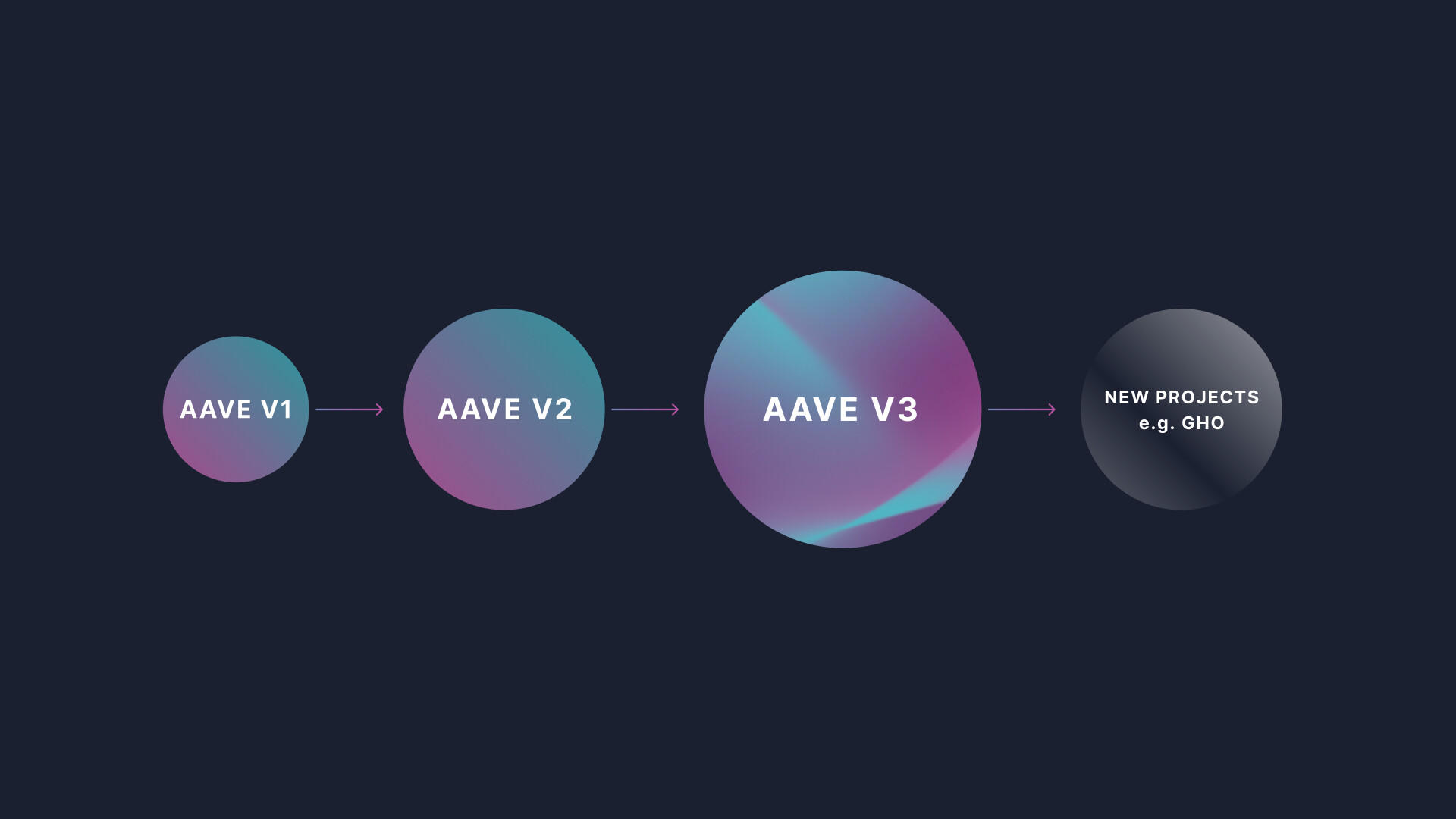

With request, permission and support granted by the Aave DAO, the Aave Companies have been an important contributor for the protocol, alongside others such as BGD Labs, Gauntlet, Certora, SigmaPrime, Llama and others. We have been building exciting innovations within the Aave ecosystem and want to continue doing so. A brief overview of this work that has taken place over many years is visualized in the simple diagram below:

As the Aave protocol has grown into what it is today, costs associated with development have risen substantially. For example, security has always been a cornerstone of protocol development, and this has become more crucial as Aave’s TVL has increased. Building an innovative, secure and battle-tested version of a protocol such as Aave V3 requires experienced builders across a variety of skill sets that are fairly compensated for their work.

V3’s Technological Advancements and Success

In 2019, the first version of the Aave Protocol smart contracts was deployed on Ethereum. Users were able to obtain and provide liquidity and earn yield on the liquidity they provided. In 2021, V2 of the Aave Protocol saw new features such as credit delegation, debt tokenization, and optimized gas costs. V2 established the Aave Protocol as a DeFi primitive, substantially growing the community and ecosystem.

Whilst V2 provided a solid foundation, through community feedback, it became clear that to scale the Aave Protocol, capital efficiency and risk management would need to be central to the protocol’s functionalities.

Aave V3 therefore iterates on the previous versions, solving limitations present in V2 while pushing innovative features to the forefront of the protocol. Here are just a few of these features and improvements:

- High Efficiency Mode allows borrowers to extract the highest borrowing power out of their collateral;

- Isolation Mode limits exposure and risks to the protocol from newly listed assets by only permitting borrowing up to a specific debt ceiling;

- Risk Management Improvements provide additional protection for the protocol through various risk caps and other tools;

- L2-Specific Features designs specific to Layer 2 networks to improve user experience and reliability;

- Portal allows assets to seamlessly flow between Aave V3 markets over different networks;Community Contribution facilitates and incentivizes community usage through a modular, well-organized codebase.

These new features offer flexibility for Aave V3 users. In the last few months, new markets have been created based on community proposals thanks to the V3 supply caps and isolation mode, which add risk mitigation features so that the community can manage such markets on the Aave Protocol.

One of the most talked about features of V3, Portal, has already found a use case for bridges like Connext as detailed in their proposal to the Aave DAO, allowing for Connext’s LPs to access immediate extra liquidity to fulfil transactions in a trust minimized way. Other proposals have followed suit, such as this one from deBridge.

V3 has also seen demand for stable Efficiency Mode (eMode), with proposals for new asset listings such as this one for FRAX continually taking advantage of Aave V3’s capital efficiency. So far, over 4,100 borrowing addresses have enabled eMode, accounting for 12% of all borrowing wallets on V3. Power users and automated strategies likely will utilize eMode more frequently as more liquidity enters market ecosystems. In light of recent significant crypto market events, risk management features such as isolation mode have also proven to be prescient.

Aave V3 markets attracted liquidity quickly, with the Avalanche V3 market growing to a market size of $2.22 billion, driven by the Avalanche Rush rewards despite adverse market conditions. Much of this growth was in stable assets, accounting for ~60% of total supply since mid-April. We have seen this growth in activity mirrored on V3 on Optimism, which in the recent weeks has risen to a market size of $2 billion. We expect this increase in liquidity and usage to be mirrored across other versions of Aave V3 moving forward.

During May and June’s difficult crypto-ecosystem events, liquidations functioned well across V3 markets, minimizing insolvencies while market size was reduced by two thirds. V3 also provides the ability to set liquidation collection factors, meaning the DAO can benefit from fee accumulation during liquidation events. This is particularly pertinent given the extent of recent liquidation events in the industry.

These examples are only the tip of the iceberg, and we expect V3 to continue to further prove itself over time as users experiment with the new features and opportunities. The Aave Grants DAO has been playing, and will continue to play, a large role in this by helping to fund creative projects that take advantage of V3 and add value to the Aave ecosystem.

What is the Compensation Model based on?

We propose that the Aave DAO retribute $15 million (work incurred) and $1.28 million (audits) to the Aave Companies to retroactively fund the development of Aave V3, cover the cost of audits, incentivize further building on the Aave Protocol, and enable sustainable building within the Aave ecosystem. This request covers the work done by members of the Aave Companies over more than a year.

Overall, there were multiple functions involved in V3’s creation. These functions included Data Science, Risk Management, QnA, Dev Ops, Smart Contract Engineering, Front-end Engineering, Back-end Engineering, Product, and Design. On top of the direct work done on V3 by the aforementioned departments there were a number of supporting measures that helped maintain high standards of security and quality throughout the process.

Below you can find a breakdown of the different teams that make up the Aave V3 Working Group at the Aave Companies:

In terms of costs related to incurred work for V3, 60% are associated with engineering roles, whilst 40% are related to non-engineering roles.

More than full-time personnel costs, there were significant operational costs associated with the creation of V3, from equipment to software, which is included in our calculations for incurred work.

There were also two rounds of extensive and in-depth audits. The first round of audits was conducted by ABDK, OpenZeppelin, Trail of Bits, and Peckshield. The second round was done by SigmaPrime. Certora provided formal verification. These were important expenses given the Aave community’s high standards regarding security and ethos. A more digestible breakdown of these security measures is shown in the table below:

| Auditor | Date | Report | Round |

|---|---|---|---|

| ABDK | 27-01-2022 | ABDK | 1 |

| OpenZeppelin | 01-11-2021 | OpenZeppelin | 1 |

| Trail of Bits | 07-01-2022 | Trail of Bits | 1 |

| Peckshield | 14-01-2022 | Peckshield | 1 |

| SigmaPrime | 14-01-2022 | SigmaPrime | 2 |

<a name="compesation">Compensation Model</a>

If the AIP is approved by the DAO, the Aave team will receive $16,280,000 million in retroactive funding for the development of Aave Protocol V3. The funding will consist of $5,456,993.61 between DAI, USDT and USDC; $1,148,881.31 in alternative stable assets, $3,394,125.08 million in more volatile crypto assets; and $6,280,000 million in AAVE tokens.

The $6.28 million in AAVE tokens requested will be based on a 14-day TWAP - time weighted average price (average of open, high, low, close) per Messari at UTC+0 - from the moment the proposal is approved in a Snapshot vote.

The funding of the aforementioned $6.28 million in AAVE tokens will be reimbursed with two lock-up periods. 50% of the AAVE tokens received will be deposited in the Safety Module for one year, whilst the other 50% of AAVE tokens will be deposited in the Safety Module for two years. During this time, the tokens will contribute to the protocol safety module, helping to reduce risk for the protocol. Based on this model, Aave Companies would be free to use the tokens after the end of each lock-up period.

We request that the USDC, DAI, and USDT be broken down as follows:

| USDC | DAI | USDT | |

|---|---|---|---|

| Approximate % Breakdown | 51% | 30% | 19% |

| Total $ Value Requested | $2,783,066.74 | $1,637,098.08 | $1,036,828.78 |

Regarding the $1,148,881.31 in alternative stable assets, a small volatility discount has been applied to each asset to account for peg fluctuations and low liquidity. These discounts are based on the lowest close price of each asset in the past 90 days. An itemized view of the requested alternative assets and their respective discounts can be found below:

| Token | Volatility Discount | Number | Value |

|---|---|---|---|

| sUSD | -0.2% | 463,358.33 | 462,526.88 |

| TUSD | -0.4% | 292,927.66 | 291,647.27 |

| FRAX | -1.4% | 154,992.10 | 152,830.21 |

| BUSD | -0.5% | 130,749.62 | 130,142.79 |

| GUSD | -1.4% | 86,354.30 | 85,154.05 |

| USDP | -1.1% | 26,871.32 | 26,580.10 |

| Total | $1,148,881.31 |

Further, the remaining $3,394,125.08 that will be composed of more volatile crypto assets will remain fixed. The price will be determined by TWAP - time weighted average price (average of open, high, low, close) per Messari at UTC+0 on the day the Snapshot vote is made.

Looking at the volatility of ETH over the last week, there is daily implied volatility of 5%. This does not mean that every day ETH will move by 5%, but on average, the general size of the moves will be so big that their standard deviation will be 5%.

Assuming a normal distribution of returns, there is a 68% chance prices move 5% daily, a 95% chance that prices move 10% and 99% chance they are 15%. When looking at the actual daily movements we see an average difference between the daily high and low prices of 6.6%, with a maximum difference of 13.2%. With the exception of BTC, most assets we are requesting have volatility equal to or exceeding ETH.

Given the time delay of at least 1-2 weeks between the end of the Snapshot and execution of the AIP, we are asking for a flat 10% discount on the market value of non-stable crypto assets to account for this extreme market volatility. This accounts for expected daily volatility of the assets and the time delay between asset pricing and any hedge execution we need to make.

Any difference between the aforementioned $3,394,125.08 value and the TWAP value at the close of the Snapshot will be made up for with additional AAVE tokens which will not be subject to a lock if the price of the assets has reduced. If the volatile assets are worth more than $3,394,125.08 after the discount at the conclusion of the Snapshot vote, then the amount of USDC et al will be lowered proportionally. This is to ensure the amount of stable funding requested from the DAO remains fixed.

A detailed breakdown of the requested assets with the 10% discount outlined can be found below:

| Token | Volatility Discount | Tokens Requested | Current Price | Value w/ Discount |

|---|---|---|---|---|

| WMATIC | 10% | 850,000.00 | 0.80 | 612,000.00 |

| WAVAX | 10% | 29,000.00 | 22.60 | 589,860.00 |

| CRV | 10% | 509,732.68 | 1.10 | 504,635.36 |

| WETH | 10% | 350.00 | 1,597.00 | 503,055.00 |

| WBTC | 10% | 23.62 | 21,300.00 | 452,817.23 |

| SNX | 10% | 96,251.92 | 3.00 | 259,880.19 |

| RAI | 10% | 66,094.61 | 2.92 | 173,535.14 |

| MANA | 10% | 103,234.63 | 0.82 | 76,558.80 |

| LINK | 10% | 12,053.48 | 7.01 | 76,045.43 |

| YFI | 10% | 7.08 | 8,951.00 | 57,067.95 |

| CVX | 10% | 5,137.26 | 5.29 | 24,458.50 |

| MKR | 10% | 30.36 | 835.00 | 22,812.38 |

| KNC | 10% | 12,031.49 | 1.85 | 20,032.43 |

| UNI | 10% | 1,685.66 | 6.99 | 10,604.50 |

| ENJ | 10% | 7,242.48 | 0.55 | 3,585.03 |

| xSUSHI | 10% | 2,331.22 | 1.58 | 3,314.99 |

| BAT | 10% | 6,395.16 | 0.36 | 2,072.03 |

| REN | 10% | 15,300.17 | 0.13 | 1,790.12 |

| Total | $3,394,125.08 |

This compensation model aims to reduce the burden on the DAO’s stablecoin reserves by diversifying the requested compensation to include other assets from the DAO treasury.

As part of this retro funding proposal, we gave great consideration to the continued economic health of the DAO and the variety of tokens requested.

With these amendments, this ARC will go to Snapshot for vote by the DAO.

Conclusion

To conclude, this proposal outlines a request for the Aave DAO to provide feedback and validation for granting Aave Companies funding for the creation of Aave V3.

Aave V3 is a protocol that emphasizes capital efficiency, security, and risk management. It is a reflection of both the current and future success of the community.

Specification

This proposal transfers the requested funds to the Aave Companies, following the compensation model described above. The requested assets are pulled from multiple contracts, fee collectors and ecosystem reserves across networks.

These are the main actions included in the proposal:

- Transfer of AAVE assets from the Aave Ecosystem Reserve.

- Transfer of aToken assets from the AaveCollector of Ethereum V2 Market.

- Upgrade the AaveCollector contract of Polygon V2 and V3 Markets to add the ability to retrieve funds from themselves.

- Transfer of aToken assets from the AaveCollector of Polygon V2 Market.

A detailed breakdown of the assets to transfer, following the considerations described in the Compensation section, can be found below:

| Received Token | # Tokens | Market Value USD (w/ Discount) | Transfer Method |

|---|---|---|---|

| aAvaWAVAX | 9584.301837 | $164,451.39 | Manual |

| aAvaWBTC | 1.077275 | $19,376.34 | Manual |

| AAVE | 76196.367344 | $6,533,944.52 | On-chain |

| aBAT | 6395.160000 | $1,927.71 | On-chain |

| aBUSD | 130399.257103 | $129,794.20 | On-chain |

| aCRV | 509732.680000 | $519,461.65 | On-chain |

| aCVX | 5137.260000 | $23,534.81 | On-chain |

| aDAI | 1637098.070000 | $1,637,098.07 | On-chain |

| aENJ | 7242.480000 | $3,339.30 | On-chain |

| aFRAX | 154992.100000 | $152,829.96 | On-chain |

| aGUSD | 86354.300000 | $85,153.98 | On-chain |

| aKNC | 11236.269638 | $17,632.12 | On-chain |

| aLINK | 12053.480000 | $73,118.35 | On-chain |

| aMANA | 103234.630000 | $71,608.23 | On-chain |

| aMKR | 30.360000 | $20,592.35 | On-chain |

| amWBTC | 16.656090 | $299,583.70 | On-chain |

| amWMATIC | 850000.000000 | $656,394.81 | On-chain |

| aPAX | 26871.320000 | $26,580.03 | On-chain |

| aRAI | 66094.610000 | $7,874.06 | On-chain |

| aREN | 15300.170000 | $1,670.62 | On-chain |

| aSNX | 96251.920000 | $256,779.94 | On-chain |

| aSUSD | 463358.329101 | $462,526.88 | On-chain |

| aTUSD | 292839.518601 | $291,559.81 | On-chain |

| aUNI | 1681.265487 | $9,370.44 | On-chain |

| aUSDC | 2783066.720000 | $2,783,066.72 | On-chain |

| aUSDT | 1036828.780000 | $1,036,828.78 | On-chain |

| avWAVAX | 19415.698163 | $333,142.53 | Manual |

| avWBTC | 1.807146 | $32,504.12 | Manual |

| aWBTC | 3.388551 | $60,947.95 | On-chain |

| aWETH | 350.000000 | $492,366.99 | On-chain |

| aXSUSHI | 2331.216007 | $2,922.55 | On-chain |

| aYFI | 7.080000 | $57,880.72 | On-chain |

| BUSD | 350.362897 | $348.74 | On-chain |

| KNC | 795.220362 | $1,247.87 | On-chain |

| TUSD | 88.141399 | $87.76 | On-chain |

| UNI | 4.394513 | $24.49 | On-chain |

| WBTC | 0.445770 | $8,017.82 | On-chain |

| Grand Total | 8405344.837285 | $16,275,590.32 |

Test Cases

Please refer to the test section of the aave/v3-retroactive-funding repository.

Implementation

The aave/v3-retroactive-funding repository contains all the code, tests and scripts needed to deploy, execute and test the governance proposal.

Relevant contracts:

Copyright

Copyright and related rights waived via CC0.

Your voting info

Voting results

YAE

NAY

Active ends

in an hourRequired

669.08K

320.00K

Required

669.08K

80,000.00

16,000,000

Proposal details

Block

~ 05 Sep 2022, 05:23 pm

15479095

Block

~ 05 Sep 2022, 05:23 pm

15479095

AaveCompanies