Proposal overview

Adjust interest rate to account for APY over-approximation

Simple Summary

- Update interest rate on AMPL market to account for over-approximation in compounded interest computation.

- Make use of the exponential curve due to the over-approximation to set higher max APY.

Motivation

In AAVEs MathUtils an over-approximation in the application of the interest rate for computing compounded interest was discovered.

In calculateCompoundedInterest method

Periodic rate (per second) is computed as:

uint256 ratePerSecond = rate / SECONDS_PER_YEAR;

in comparison to the exact computation.

derived from:

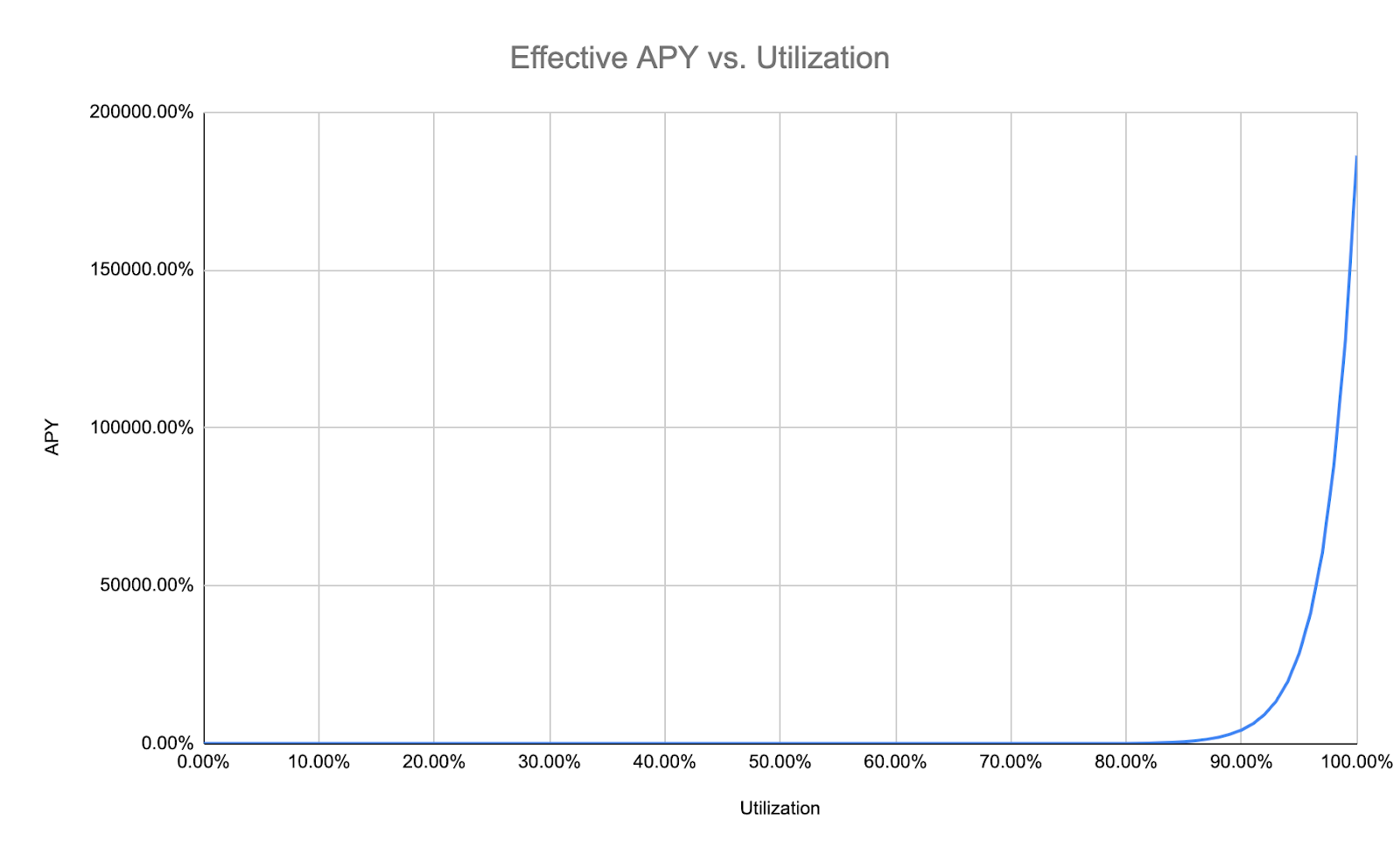

The deviation in the applied interest rate causes a small over-approximation for APYs <10%, but grows exponentially as can be seen below.

| Expected APY | Effective APY | Expected daily rate | Effective daily rate |

|---|---|---|---|

| 4.00% | 4.08% | 0.01% | 0.01% |

| 5.00% | 5.13% | 0.01% | 0.01% |

| 10.00% | 10.52% | 0.03% | 0.03% |

| 50.00% | 64.87% | 0.11% | 0.14% |

| 100.00% | 171.83% | 0.19% | 0.27% |

| 200.00% | 638.91% | 0.31% | 0.55% |

| 1000.00% | 2202543.09% | 0.68% | 2.78% |

| 10000.00% | 2.69E+43% | 1.30% | 31.52% |

This difference is especially noticeable in the AMPL market, where the configured interest rate can go up to 10,002% at max utilization.

The AAVE Genesis team has been made aware and they will publish more guidance on the discrepancy.

Specification

As mentioned in AIP-26, a nonlinear - logistic or exponential - interest curve is more suited for AMPL's market and potentially other assets on AAVE's platform.

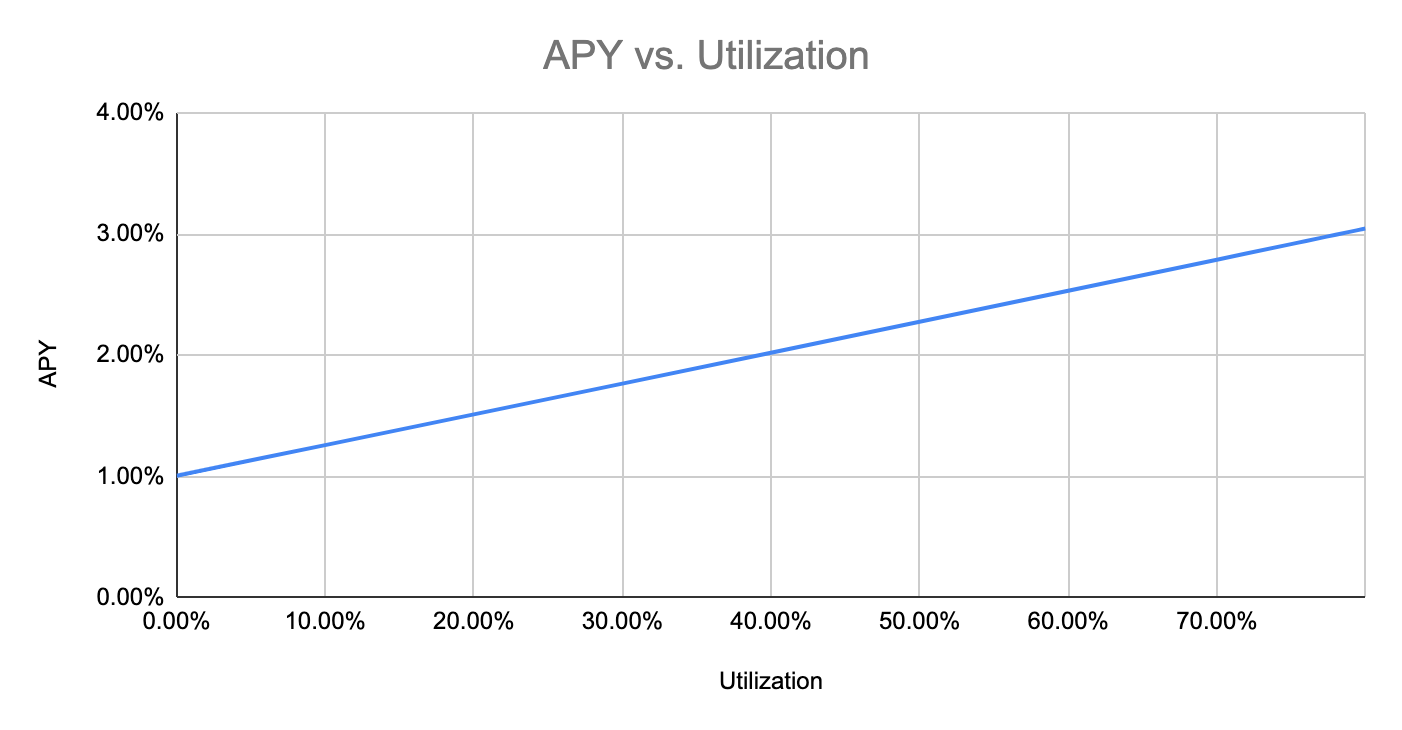

The over-approximation mentioned above results in an exponential curve which allows for defining a more suitable interest curve for AMPL. We propose the following parameters, which produces the curve below.

- Optimal utilization = 80%

- Base rate = 1%

- Slope1 = 2%

- Slope2 = 750%

APY table above 80% Utilization:

| Utilization | APY |

|---|---|

| 80.00% | 3.05% |

| 81.00% | 49.93% |

| 82.00% | 118.15% |

| 83.00% | 217.40% |

| 84.00% | 361.82% |

| 85.00% | 571.94% |

| 86.00% | 877.67% |

| 87.00% | 1322.50% |

| 88.00% | 1969.72% |

| 89.00% | 2911.43% |

| 90.00% | 4281.60% |

| 91.00% | 6275.19% |

| 92.00% | 9175.85% |

| 93.00% | 13396.29% |

| 94.00% | 19536.98% |

| 95.00% | 28471.63% |

| 96.00% | 41471.48% |

| 97.00% | 60386.14% |

| 98.00% | 87906.81% |

| 99.00% | 127949.14% |

| 100.00% | 186210.38% |

The part of the curve under 80% Utilization:

Rationale

- Accounting for the over-approximation of the existing Slope2=10,000% interest curve requires reducing the slope2 parameter.

- Taking advantage of the exponential curve allows for: a. Setting a higher optimal utilization rate. b. Setting a higher maximum APY to reduce the potential for utilization being at 100% for extended periods without creating a too steep of an interest rate increase right above the optimal utilization rate.

Implementation

A deployment of the existing implementation of the Interest Strategy will be used, with the following parameters:

optimalUtilizationRate: new BigNumber(0.8).multipliedBy(oneRay).toFixed(),

baseVariableBorrowRate: new BigNumber(0).multipliedBy(oneRay).toFixed(),

variableRateSlope1: new BigNumber(0.02).multipliedBy(oneRay).toFixed(),

variableRateSlope2: new BigNumber(7.5).multipliedBy(oneRay).toFixed(),

https://etherscan.io/address/0x84d1FaD9559b8AC1Fda17d073B8542c8Fb6986dd#readContract

Copyright

Copyright and related rights waived via CC0.

Your voting info

Voting results

YAE

497.07K

100.00%

NAY

0

0%

Executed on

Sep 18, 2021Required

497.07K

320.00K

Required

497.07K

80,000.00

16,000,000

Proposal details

Block

~ 13 Sep 2021, 08:20 pm

13219514

Block

~ 13 Sep 2021, 08:20 pm

13219514

18 Sep 2021, 07:04 pm

Ahmed Naguib Aly (@ahnaguib)